Guide to invest (I): dangers, tempos and other factors to consider

Historical background

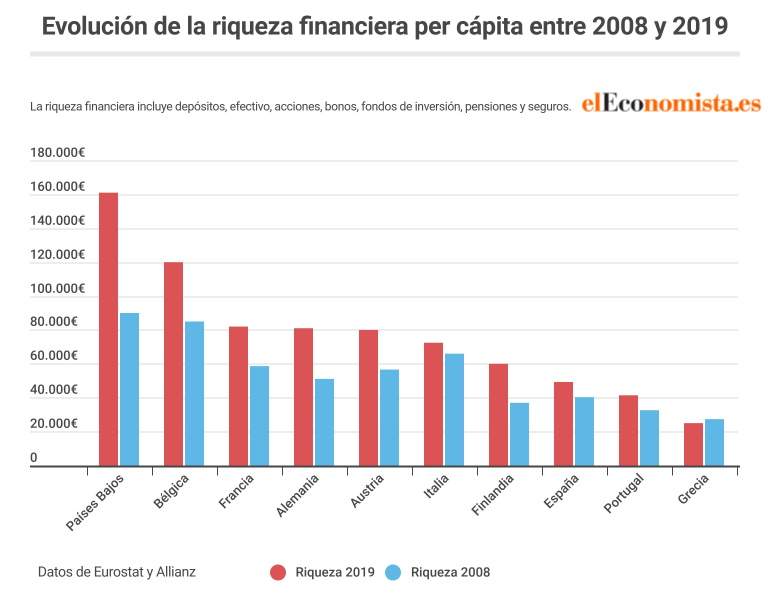

The period 2008-2019 was disastrous: it began with the "Great Recession" and ended with the outbreak of a global pandemic.

Was it such a calamitous time in terms of financial wealth per capita in the EU?

On the contrary, in all the countries analyzed, except Greece, citizens have seen their financial wealth increase. But it has done so at a very different rate depending on the country. In the Netherlands, for example, this rate has doubled, while in Spain it has risen by only 25%. One statistic starkly illustrates the savings situation in Spain: 33% of families entered the pandemic with less than €2,200 saved.

Investing everything you need to know

1. Why do citizens with enough savings invest?

Because let money in a bank account rarely earns interest. Investing, on the other hand, is a way to get a return on our savings - even if it is not 100% guaranteed.

2. What are the usual investment periods?

Short-term: less than one year,

Medium term: 1 to 3 years

Long term: more than 3 years.

3. Are there any dangers in investing?

Yes, any return always involves a certain degree of risk.

Here are three dangers of investing:

- Unpredictability: no one knows exactly what the future performance of the asset in which we invest will be.

- The poor state of personal finances: it turns putting money into a product into a "risky sport". Thus, lacking liquidity and/or solvency is fatal.

- Poor or insufficient planning: our money must perform. However, this requires knowing what you put it in, why and when to expect a return.

At Finques Feliu we will listen to your concerns, investment objectives and doubts. We will team up with you, we will put all our knowledge of the real estate market and our extensive experience at your service.

The fact of making your real estate investment a success is linked to our three values:

- Future: if we do our job well, your future will be brighter.

- Confidence: if the results are good and if we always have clear explanations, you will bet on us.

- Positivity: in these uncertain times, seeing things realistically and, at the same time, with a smile on your face is priceless.

4. What should be taken into account when investing?

The time factor: calculate the total income you receive now, estimate how much you will receive in the future and decide how long the investment will last.

The realism factor: How much of the total income can we really set aside to invest?

The word "really" is the most important because while an amount is invested in a financial product we cannot dispose of it and, when we invest in a house, it is even more difficult.

Almost always, buying a house is very different than investing in a financial product, making it the most important decision of our lives because in addition to the economic factor there is the emotional one.

As we explained any type of contract must be read carefully: the documentation that establishes the conditions of a financial product or a real estate one is not an exception.

In the case of a financial product, you must know, for example, if there is a redemption clause. In case it is executed, keep in mind that premature repayment will cut off future capital gains on the investment. When talking about a real estate product, be aware of the appearance of construction defects or undue delays in the construction in this case, depending on the casuistry of the contract, the money could be returned.

After having analyzed the fact of investing with regard to its justification and rigorous preparation in the second part of this article we will give you a brief economic vocabulary and five brief advices to maximize the benefit.